Article licensed from the Australian Financial Review license no – 38808

Robert Harley AFR Contributor Dec 1, 2021 – 5.00am

The chief executives of property heavyweights Dexus, GPT, Mirvac, and Stockland are all former executives of global developer, contractor, and fund manager Lendlease. So are the chief executives of Crown Resorts and Fletcher Building; as is the incoming chief executive of QIC. So, too, are the chairmen of Charter Hall, Mirvac and Stockland; and, in the UK, the chief executive of the Crown Estate and the chairman of Gatwick Airport.

On Wednesday, at The Australian Financial Review Property Summit, eight of the speakers will be former or current Lendlease alumni, including AMP Capital’s global head of real estate Kylie O’Connor and Charter Hall’s chief executive of office, Carmel Hourigan. All benefited from the culture, and philosophy, of legendary Lendlease founder Dick Dusseldorp, who stepped down as chairman in 1988. It is hard, a third of a century later, to comprehend the aura – of power, excitement, and blue-chip status – that Lendlease had at the time.

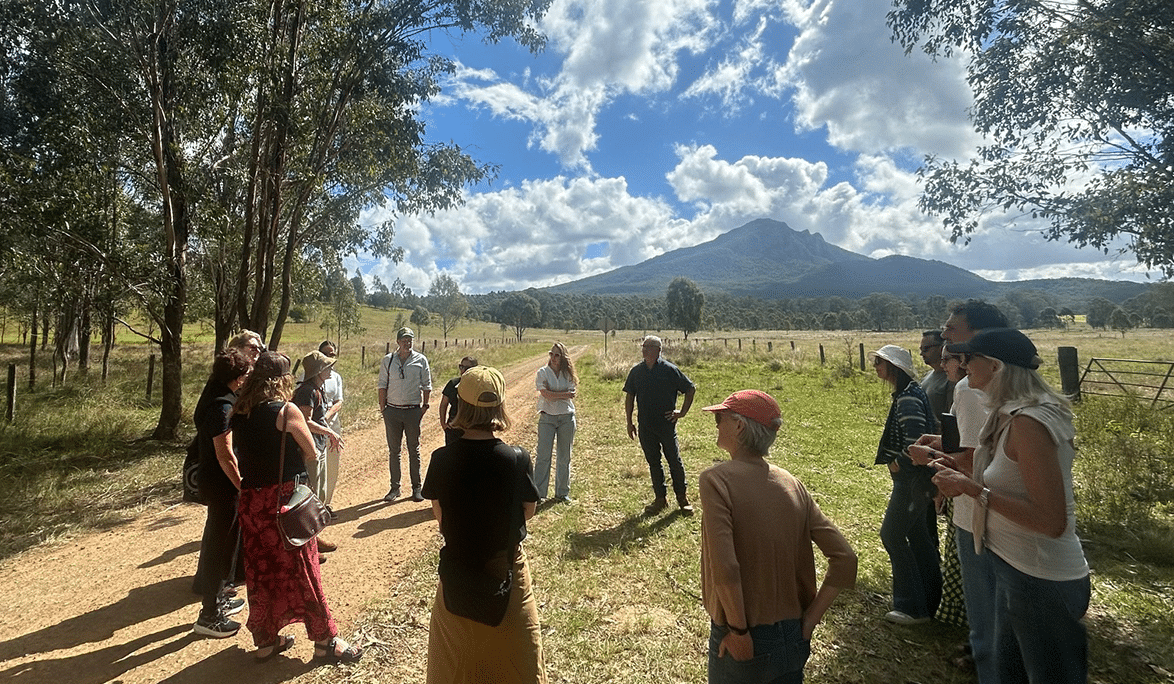

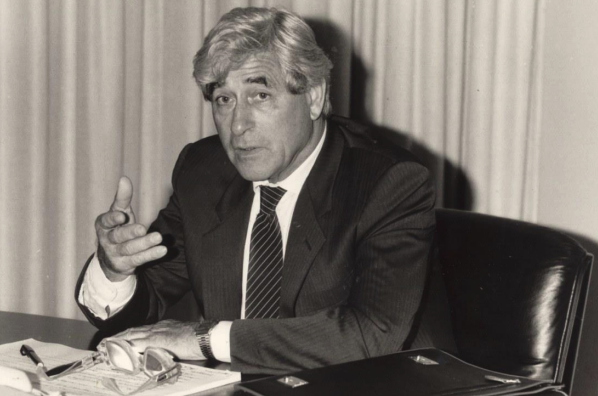

Dick Dusseldorp in 1986. Respect for employees – and shareholders, customers, and stakeholders including the government – was a fundamental tenet of the Dusseldorp philosophy.

“If you wanted to be in property, Lendlease was the place to be,” says Bob Johnston, who joined in 1988, stayed for 19 years, and is now chief executive of the GPT Group.

“Lendlease was acknowledged as ahead of its time,” he says. “It was growing and developing people. You had a sense there was a whole lot of opportunity for you to carve your way through.”

Dusseldorp had fostered that aura since arriving from the Netherlands in 1951, aged 32, to head a Dutch construction contribution to the Snowy Mountains Scheme. He then seized the nation’s post-war opportunities. His team built the base of the Sydney Opera House, reimagined both the city and the development business with landmarks such as Australia Square, housed thousands in estates like Campbelltown, floated Lendlease and GPT, and took the chance of a Ron Brierley raid on MLC to take control of a leading finance house.

As he strode the Australian corporate stage, he intrigued the writers of The Australian Financial Review, which – imagine this today – ran an eight-page feature to celebrate the topping out of Australia Square.

In September 1960, the Financial Review’s CL Cleveson wrote that Dusseldorp had been described as “unemotional, coolly objective, even arrogant”.

“All this could be the earmarks of a man who is sure of himself, and not at all unnerved at having to back his own judgments – just the type of man Mr Dusseldorp is.

“Mr Dusseldorp can certainly handle people deftly … His voice is never raised. I never heard him laugh outright, though he smiles often enough. For all his reserve, he’s not peremptory. He hasn’t that domineering manner that many men at the top feel is necessary to demonstrate their superiority.”

For a front-page story in July 1979, Valerie Lawson described Dusseldorp as “one of the few businessmen in Australia who can, and does, afford the time to philosophise without indulging in waffle: he practices what he preaches, which is why he is now sitting on top of one of the most successful property-oriented ventures in Australia.”

She asked him if the NSW alpine resort of Thredbo, which Dusseldorp pioneered and cherished, was threatened by Kerry Packer’s investment in rival Perisher. To a journalist the answer was gold. “Packer trains the beginners on his ‘kindergarten’ slopes. They then graduate to Thredbo,” Dusseldorp quipped.

Lawson finished with this; “Throughout the interview, Dick Dusseldorp fiddled with his passport: he’s off to his apartment in Manhattan, an island populated by his kind of people.”

Job security

As well as character assessment, the Financial Review did provide insights into the Dusseldorp philosophy and the way he ran Lendlease, John Edwards attended a 700-strong meeting of building workers in the Sydney Town Hall at which Dusseldorp demonstrated his philosophy of employee engagement and his oft-praised skill in addressing a crowd.

At the meeting Dusseldorp unveiled a new industrial agreement which provided improved death, sickness, and injury benefits, as well as a non-contributory superannuation scheme, which, although it would cost Lendlease an extra $750,000 a year, was designed to provide increased security rather than higher wages. “We do not relish the exercise of naked economic power,” Dusseldorp told the meeting. “Security enhances an employee’s dignity and a dignified man responds better to his responsibilities.”

The Financial Review judged that the ovation for Dusseldorp was slightly longer than that for Building Workers Industrial Union federal secretary Pat Clancy.

“As he [Dusseldorp] outlined each benefit one could distinctly hear people nearby saying ‘That’s good, yes’; or see people nodding to each other in appreciative wonder.” One worker told Edwards: “If every employer were a Dusseldorp you wouldn’t need [Builders Labourers Federation NSW leader] Jack Mundey.”

Dick Dusseldorp and the Lend Lease Corporation board of directors at the Riverside Centre in Brisbane in 1987.

Respect for employees – and shareholders, customers, and stakeholders including the government – was a fundamental tenet of the Dusseldorp philosophy, according to Geoff McWilliam, who worked directly with Dusseldorp in his 23 years at Lendlease and has returned to the group to chair its $12 billion in institutional investment funds.

“The corporation was not healthy if the return to employees, to customers, and to shareholders was out of balance,” he says. “Dusseldorp had a very clear vision of creating the best assets and then participating in the value created long term. He was always pushing the envelope and doing things differently. As chairman, his job was to look over the horizon. “It was tough. You had to perform. But the senior guys all perceived their role to help the next generation.”

GPT’s Johnston stresses Dusseldorp’s willingness to embrace change, to look for win-win outcomes that shared success, and his “enquiring mind” that was always challenging teams to do better.

He recalls Dusseldorp asking why the apartments in the Athlete’s Village at the Sydney Olympics had to be sold individually and not retained for long-term investment and value uplift. Twenty years later Lendlease’s then-partner, Mirvac, is doing exactly that with a build- to-rent project nearby.

“The DNA was engineering, taking a lateral approach to problems, and a commitment to quality,” says Andrew Parsons, who spent 10 years with Lendlease and is now chief investment officer of global real estate securities manager Resolution Capital, whose chairman, Michael Cameron, is also a Lendlease alumni.

Bevan Towning, another Lendlease alumni now the head of property at Australian Super, says Dusseldorp “hired good people and let them run”, an attribute that Dusseldorp attributed to the responsibility thrust on him as a young man.

In her 1979 front-page story, the Financial Review’s Lawson did gain an insight into the Dusseldorp management style, and the creation of specialist project control groups, which overrode any formal organisation structures and are still a feature of Lendlease.

“We try to specialise in non-specialisation,” said Dusseldorp. “That is, co-ordination of people knowing more than we will ever know, but between them unable to get together because they are not project oriented.”

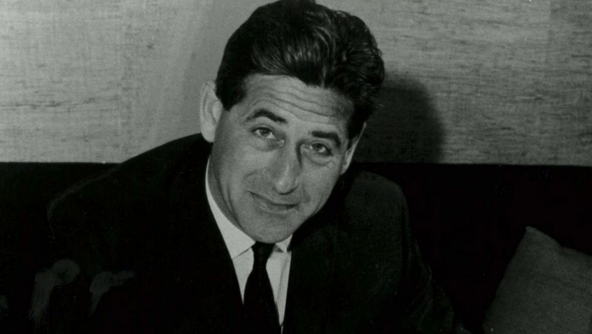

A young Dick Dusseldorp: “When you’re young, you don’t doubt yourself”

One Lendlease alumni summed it up: Dusseldorp was a leader, not a manager. Not every initiative turned to gold. There was a gamble on Bass Strait exploration with Lend Lease Petroleum in the 1980s and a long-term fixation on the US, which bore fruit after decades of false starts when, as Lendlease’s current chief operating officer, Denis Hickey, told the Financial Review’s Matthew Cranston in a November interview, the group realised the US did not need Lendlease.

“People forget that there were things that Dick tried that didn’t work,” John Morschel, one of Dusseldorp’s key executives, told Lindie Clark for her 2002 study of the man and his company, Finding Common Ground. “That didn’t stop him trying new things. [But] with new ideas he would always restrict the amount of money he would put at risk … so it didn’t become a calamity for the organisation.”

If Dusseldorp’s leadership worked for employees, customers and other stakeholders, it certainly worked for shareholders. Through the 1970s, which were fatal to many property companies, Lend Lease enjoyed 10 years of profit rises, except for a downturn in 1975, and continued its growth through the 1980s.

But, as many of today’s tech titans will discover, entrepreneurial leadership is hard to maintain. The bureaucrats and financiers take control with time, and past success breeds arrogance and hubris. Nevertheless, today’s Lendlease acknowledges Dusseldorp’s heritage.

“From its inception Lendlease has been purpose-led, with our founder Dick Dusseldorp articulating the broader social and environmental outcomes that underpin everything we do”, the current chairman, Michael Ullmer told his 2021 annual general meeting. “His vision for the company was guided by two simple principles: doing the right thing and leaving a legacy for future generations.

“At our 1973 annual general meeting he said that companies must start justifying their worth to society, with greater emphasis placed on their environmental and social impact rather than just straight economics.

“Given the integration of ESG factors into the investment decision-making process today, his philosophy was decades ahead of its time.”

Lendlease, despite missteps over the past 25 years, is ahead of the pack with flagship projects such as the Google redevelopment in California, world-leading sustainability precincts such as Barangaroo, and a commitment to be completely carbon neutral – including the tough scope 3 – by 2040.

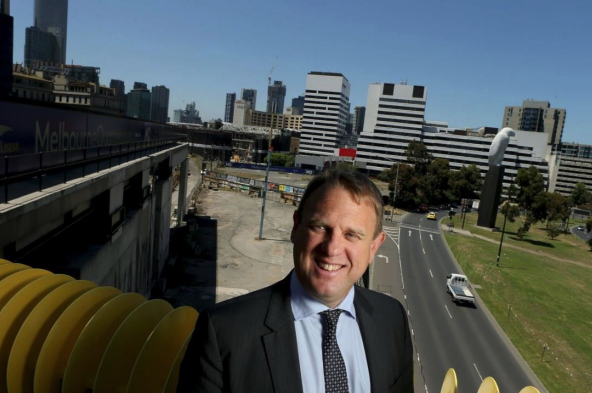

Dale Connor, who joined Lendlease in 1988 and is now the chief executive in Australia, says there is still a desire to create quality assets, safely and sustainably, that leave a legacy that Lendlease, its customers and stakeholders can be proud of.

Lendlease Australia chief executive Dale Connor says the desire is still to create quality assets that leave a legacy to be proud of. Pat Scala

“And it is still evident that we are a creator of talent,” he says, pointing to recent Lendlease alumni Kylie Rampa, who has just been appointed chief executive of QIC and Tarun Gupta, who now has the reins at Stockland.

In one key area, the 50-year issue of housing affordability, Dusseldorp’s solution has yet to be embraced. In 1973, after years of surging house prices which energised the reform attempts of the Whitlam government, Dusseldorp took a seat on the Commission of Inquiry into Land Tenures. The number-one recommendation was that all future development rights should be reserved to the Crown – a proposal that is even more radical than today’s value-capture proposals but heartily endorsed by Dusseldorp.

In a speech to the Housing Industry Association’s third annual convention, covered by the Financial Review, Dusseldorp urged that no more rural land be rezoned until it had been acquired by the government.

Similarly, in March 1974, the paper’s Annette Hornstein reported a speech to the congress of the Urban Development Institute of Australia that was critical of both government delays and the hypocrisy of developers who complained about the government difficulties while benefiting from the resultant scarcity.

“If somehow this magic supply could be doubled overnight, then half of you would be in the bankruptcy court before the end of the year,” he told what would have been a hostile audience.

Dusseldorp argued that proper housing – “not just the house but all it stood for” including the right environment and convenient facilities – would likely remain in scarce supply for decades.

“It follows that if an essential element of life is scarce and is likely to be so for a considerable period ahead, then the free market system favours the haves at the expense of the have-nots.” Sadly, that is still the case today.

Robert Harley is a former property editor of The Australian Financial Review. Contact Rob at [email protected]

Connect with Robert on Twitter. Email Robert at [email protected]